A Complete Guide to Required Documents for Property Damage Insurance

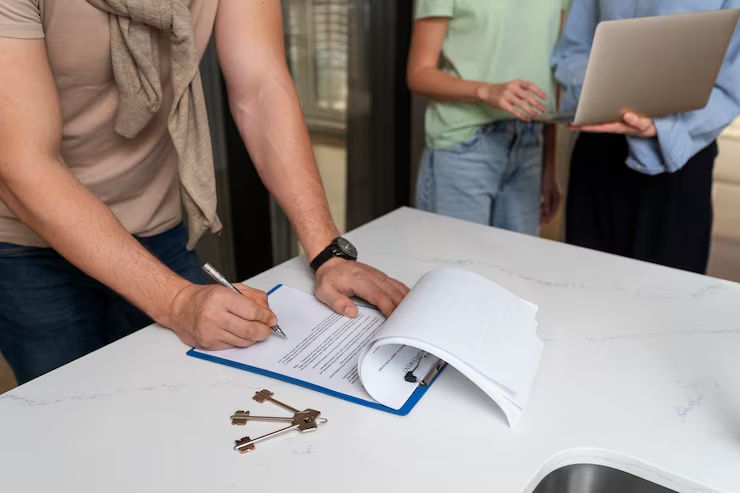

Property damage insurance is designed to help cover financial losses when physical property is damaged due to events such as fire, floods, storms, accidents, or other covered risks. When a loss occurs, policyholders are required to submit a claim to their insurance provider. This claim process relies heavily on documentation.

The requirement for documents exists to verify three key points: that the insured property exists, that damage has occurred, and that the loss falls within the terms of the insurance policy. Documents help insurers assess the extent of damage, confirm ownership, and determine the appropriate claim amount.

Over time, insurance processes have become more structured to reduce disputes, prevent fraud, and ensure fair claim settlements. As a result, documentation requirements have become more standardized across insurers.

Understanding which documents are needed for property damage insurance helps policyholders prepare in advance and respond calmly during stressful situations involving property loss.

Importance

Knowing the required documents for property damage insurance is important because it directly affects how smoothly and quickly a claim is processed.

Why this topic matters today

-

Property damage incidents can occur unexpectedly

-

Insurance claims involve time-sensitive procedures

-

Incomplete documents can delay claim settlement

-

Digital claim systems require accurate uploads

When documentation is incomplete or unclear, insurers may request additional information, which can extend the claim timeline. Being prepared reduces uncertainty during already difficult situations.

Who this topic affects

This topic is relevant for:

-

Homeowners and tenants

-

Commercial property owners

-

Landlords and housing societies

-

Small business owners

-

Individuals with property insurance policies

It also affects surveyors, insurers, and claims managers who rely on documentation to make fair assessments.

Problems proper documentation helps solve

| Claim Challenge | How Documents Help |

|---|---|

| Delayed claim processing | Faster verification |

| Disputes over damage | Clear evidence |

| Ownership confusion | Proof of possession |

| Coverage uncertainty | Policy clarity |

| Claim rejection risk | Complete submission |

Proper documentation supports transparency and helps both insurers and policyholders follow a clear process.

Recent Updates

Property insurance documentation practices have seen gradual changes due to digitalization and regulatory focus.

Key developments in the past year

-

2024–2025: Increased digital claim submissions

Many insurers now encourage online claim filing with scanned or photographed documents. -

2025: Faster claim processing through standardized checklists

Insurers have introduced clearer document lists to reduce back-and-forth communication. -

Late 2024: Greater emphasis on photo and video evidence

Visual proof of damage has become more important for initial assessments. -

Ongoing: Improved communication through claim tracking portals

Policyholders can now track document review status online.

Documentation trend overview

| Area | Recent Trend |

|---|---|

| Claim filing | Digital platforms |

| Evidence type | Photos and videos |

| Communication | Online tracking |

| Clarity | Standard document lists |

These updates aim to make the claims process more efficient and transparent.

Laws or Policies

Property damage insurance documentation is influenced by insurance regulations and consumer protection laws. In India, several legal frameworks apply.

Relevant laws and regulations in India

-

Insurance Regulatory and Development Authority of India (IRDAI)

Sets guidelines for claim settlement timelines and fair practices. -

Insurance Act and related rules

Define insurer responsibilities and policyholder rights. -

Consumer Protection Act

Provides recourse in case of unfair claim handling or delays. -

Standard fire and property insurance guidelines

Outline documentation requirements for different types of property damage.

Regulatory impact overview

| Regulation Area | Relevance |

|---|---|

| Claim timelines | Timely settlement |

| Documentation clarity | Fair assessment |

| Consumer rights | Dispute resolution |

| Insurer accountability | Transparent process |

These laws aim to protect policyholders while maintaining claim integrity.

Tools and Resources

Several tools and resources can help policyholders organize and submit documents for property damage insurance claims.

Commonly required documents

-

Insurance policy document

Shows coverage details and policy number -

Claim form

Provides official notification of loss -

Proof of ownership or occupancy

Property deed, lease agreement, or utility bills -

Damage evidence

Photos or videos showing affected areas -

Repair estimates or invoices

From authorized service providers or contractors -

Incident report

Fire brigade, police report, or local authority notice (if applicable)

Helpful tools and services

| Tool or Resource | Purpose |

|---|---|

| Claim document checklist | Ensures completeness |

| Mobile camera apps | Capture clear evidence |

| Cloud storage | Safe document backup |

| Insurer claim portals | Upload and track documents |

| Government ID services | Identity verification |

Using these tools helps maintain accuracy and avoid document loss.

FAQs

What documents are usually required for a property damage insurance claim?

Common documents include the insurance policy, claim form, proof of ownership or occupancy, photos of damage, and repair estimates.

Are original documents required?

Most insurers accept digital copies initially, but original documents may be requested during verification.

How soon should documents be submitted after damage?

Documents should be submitted as soon as possible after the incident, as delays may affect claim processing.

What if some documents are missing?

Insurers may allow alternative documents, but missing information can slow down the claim review.

Do all property damage claims need a surveyor report?

Many claims involve a surveyor inspection, especially for significant damage, but requirements vary by insurer and claim size.

Final Thoughts

Property damage insurance is meant to provide financial support during difficult situations, but the effectiveness of a claim depends heavily on documentation. Understanding which documents are required and why they matter helps policyholders approach the claims process with clarity and confidence.

While requirements may vary slightly depending on the insurer and type of damage, the underlying purpose of documentation remains the same: to verify loss and ensure fair settlement. Preparing documents in advance, maintaining digital copies, and following insurer guidelines can significantly reduce stress and delays.

By viewing documentation as a supportive tool rather than a hurdle, policyholders can navigate property damage insurance claims more smoothly and responsibly.